process of opening a company in Laos

Step-by-Step Process to Open a Company in Laos Establishing a company in Laos can be a profitable move, especially in sectors such as agriculture, hydropower, mining, tourism, and trade. However, it requires compliance with local laws and procedures. Here's a general outline of the process:

Tax System and Investment Incentives in Laos

1. Tax Policy in Laos a. Corporate Income Tax (CIT) Standard rate: 24% on net profit. Certain sectors or investment zones may qualify for reduced or zero tax rates under incentive programs (see below).

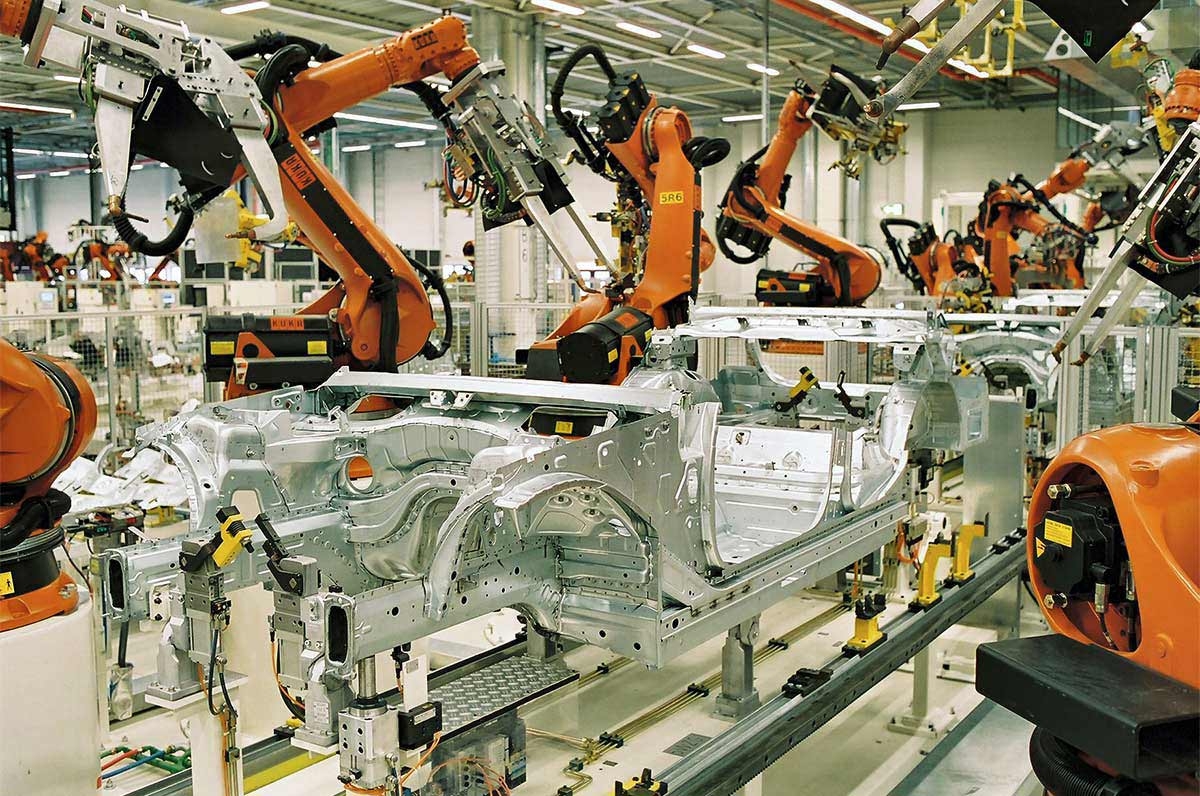

agriculture, mining, tourism, and manufacturing

An in-depth overview of Laos’s four key economic sectors: agriculture, mining, tourism, and manufacturing. Highlights each sector’s contribution to national development, explores recent trends, identifies challenges, and examines opportunities for sustainable growth and diversification.

procedures for leasing or purchasing land, and obtaining electricity & water supply in Laos

A practical guide to navigating land leasing and purchasing processes in Laos, including legal requirements and documentation. Also details the steps to obtain essential utilities such as electricity and water for residential or commercial purposes, offering clear insights for investors, expatriates, and business owners.